Cerrado Gold is maximizing asset value at its Minera Don Nicolas operation through continued operational optimization and is growing production through its operations at the Las Calandrias Heap Leach project.

Cerrado Gold Inc. has announced production results for the fourth quarter of 2023 ("Q4 2023") from the Minera Don Nicolas Mine in Santa Cruz Province, Argentina ("MDN"). Full financial results are expected to be released in late April 2024.

Q4 Operating Highlights

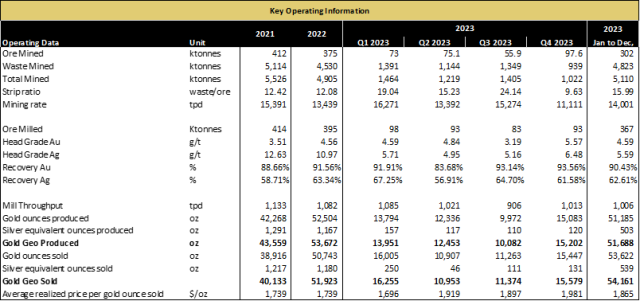

- Q4 2023 GEO production of 15,202 ounces and annual GEO production of 51,688 ounces for 2023.

- Ramp-up of production from the Las Calandrias heap leap project continues; commercial production delayed to end of Q1 2024.

- Pre-strip at Calandrias Norte largely complete and higher-grade ore beginning to feed the mill.

- Major capital programs at MDN complete, with current focus on delivering cashflow, rebuilding the balance sheet and longer-term exploration and mine life extension.

Operational results presented for Q4 2023 continued to be impacted by the slower than expected ramp-up of the Calandrias Heap Leach project during the quarter while a new crushing system was installed. The crushing unit is now operational, and mining rates are reaching planned capacity. Production is set to ramp-up over the first quarter of 2024 and achieve nameplate production rates from April thereafter. At Calandrias Norte, stripping activities were largely completed during the quarter and the pit is now beginning to deliver ore to the CIL plant at Martinetas. Ore is expected to fill the mill by mid-February onward. Head grades from Calandrias Norte are reconciling well with the model and grades are expected to increase as early benches are mined and deeper, higher grade levels accessed.

While production levels have begun to improve, the delay in the ramp up of the heap leach operations, the costs associated with stripping at Calandrias Norte and debt repayment associated with capital projects have had an impact on the financial performance at MDN. Newly introduced fiscal policies that have resulted in hyper-inflation have also had a significant impact on the operations of the business particularly as suppliers react to the new fiscal regime in Argentina.

Mark Brennan, CEO and Chairman commented, "While the second half of the year has been challenging starting with unusually harsh winter conditions in August resulting in a slower ramp up at the heap leach, we see operations at MDN positioned to turn the corner in February as we access higher grade ore from Calandrias Norte and the leach cycle at Las Calandrias normalizes. That said, recent changes to fiscal policies in Argentina have resulted in a highly inflationary environment, impacting operations as costs have increased and suppliers have reduced payment terms. The focus at MDN will move to generating cashflow from our capital investments in 2023 that allow us to rebuild the balance sheet and refocus our efforts on exploration and increasing the overall life of mine at MDN."

Stripping at Calandrias Norte continued during the quarter. The Pre-Strip is now largely complete allowing for fresh ore to fully feed the mill.

Ore milled increased during the fourth quarter as operations normalized. Production rates improved in Q4 as the operating environment returned to normal. However, additional gold production expected from the heap leach has been limited in the 4th quarter as irrigation was paused to allow for the completion of the installation of the new crushing circuit. Total production from the heap leach in the 4th quarter was 531 ounces. Please see Table 1. for a summary of key highlights for the fourth quarter and full year 2023. Sales for the quarter were slightly higher than production due to timing differences.

Ongoing work to optimize mine sequencing and exploration work to upgrade and define new sources of resources remains the key focus of development at MDN. The operations team is focused on numerous new growth projects aside from expanding current open pit resources, including the completion of the ramp up of Las Calandrias Heap Leach operation and the review of a potential new Heap Leach operation at Martinetas.

Table 1. Key Operating Information

Monte Do Carmo Update

At the Company's Monte Do Carmo ("MDC") project in Brazil, as announced on December 15th, Cerrado filed its 43-101 Updated Feasibility Study Technical Report for MDC ("FS") with an updated After-Tax NPV5% of US$390 Million and IRR of 34%. A Summary of the results of the FS are summarized in Table 1. Below. The License of Installation/Construction ("LI") is expected to be granted during the Q1 2024.

Table 1.

| Summary of Key Results and Overall Project Economics Production | Units | Value |

| Steady State Throughput | Mtpa | 1.92 |

| Average Annual Production | K oz per annum | 95,212 |

| Life of Mine | Years | 9.0 |

| Life of Mine Au Recovery | % | 95.64 |

| Total Ore Mined – Open Pit | Mt | 14.3 |

| LOM Average Stripping Ratio | x | 7.84 |

| Total Ore Mined – Underground | Mt | 2.5 |

| Total Recovered Gold (Payable) | Ounces | 856,905 |

| Operating Costs | Units | Value |

| Mining | US$/tonne | 17.01 |

| Processing | US$/tonne | 9.11 |

| Water and Tailings Management | US$/tonne | 1.45 |

| G&A | US$/tonne | 2.21 |

| Total Cash Costs | US$/oz | 583.7 |

| AISC | US$/oz | 686.6 |

| Capital Expenditure | Units | Value |

| Initial Capital | US$ M | 165.6 |

| Contingency | US$ M | 15.8 |

| Total Upfront Capital | US$ M | 181.4 |

| Sustaining Capital | US$ M | 66.0 |

| Closure Costs | US$ M | 15 |

| Total Capital | US$ M | 262.4 |

| Financial Results | Units | Value |

| Pre-Tax NPV | US$ M | 466 |

| Pre-Tax IRR | % | 37 |

| Pre-Tax Payback Period | Years | 2.0 |

| After Tax NPV | US$ M | 390 |

| After Tax IRR | % | 34 |

| After Tax Payback Period | Years | 2.1 |

| Assumptions | Units | Value |

| Gold Price | US$/oz | 1,750 |

| Discount Rate | % | 5.0 |