Silver Mountain Resources Inc. is a silver explorer and mine developer planning to restart production at the Reliquias underground mine and undertake exploration activities at its prospective silver camps at the Castrovirreyna Project in Huancavelica, Peru.

Silver Mountain Resources Inc. announced that it has received results from locked cycle metallurgical tests on representative samples from several mineralized veins within its 100% owned Reliquias mine, central Peru. These results show substantial upgrades compared to previous results and include gold recoveries for the first time. Furthermore, silver and gold payables into the bulk concentrate are expected to be around 95% and 75%, respectively.

Alvaro Espinoza, CEO of Silver Mountain, stated: “We are rapidly advancing towards production at Reliquias, and the completion of this metallurgical testwork is a major milestone for the Company. The locked cycle tests show that we can potentially produce two marketable products from Reliquias: A silver rich bulk concentrate and a high quality zinc concentrate with higher zinc grades than are currently produced on average in Peru. We are particularly pleased with the gold recoveries and grades obtained from the bulk concentrate, the first time these values are published for Reliquias. With these results in hand, we will work towards preparing the first preliminary economic assessment on Reliquias, and our teams continue to tirelessly move the Project towards the planned restart of production during the first half of 2025.”

Discussion of Metallurgical Testwork Results

Seven composite samples were sent to C.H. Plenge S.A. (“Plenge”), a reputable metallurgical laboratory located in Lima, Peru, for locked cycle testwork aimed at optimizing and improving on the historical recoveries reported by the previous operators at Reliquias. Each composite weighed between 30 and 70kg, totalling 461.5kg between all seven samples. The composites were collected from the Pozo Rico, Perseguida, Meteysaca, Matacaballo, Sacasipuedes, Vulcano and Pasteur veins. Samples were collected from both half core HQ diameter core from the 2023 drill program, and from underground samples collected from newly rehabilitated tunnels. The spatial distribution of the sampling was designed to provide representative samples to incorporate into a preliminary economic assessment (“PEA”), expected to be completed during the first half of 2024.

The Reliquias mine and the Caudalosa processing plant have historically produced two products: a bulk concentrate containing copper, lead, and silver; and a zinc concentrate. Locked cycle testwork was completed on all samples using a primary grind of 120 microns. A regrind to 11 microns was used to optimize recoveries for the zinc concentrate circuit. All the equipment and collectors used are industry standard and can be readily replicated at the Caudalosa facility once it is refurbished and re-recommissioned.

Richard Contreras, the Company´s COO, remarked: “The conclusion of this detailed metallurgical testwork is that the Reliquias mineralization has consistent low iron contents and a medium work index of 10.5 kW-h/ton, with rapid cinematics. Flotation is achieved within the initial few minutes using the selected reagents. The high recoveries and bulk and zinc concentrate grades are expected to be commercially viable, both due to their quality and for the low quantities of penalty elements such as antimony, bismuth, arsenic, or mercury.”

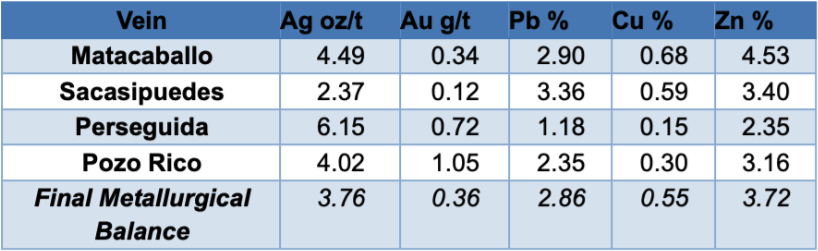

A final metallurgical balance, based on 40% material from the Matacaballo Vein, 40% material from the Sacasipuedes vein, 10% from the Perseguida and 10% from the Pozo Rico vein, was used to project overall recoveries from the Relliquias mine. The head grades are summarized in Table 1:

Table 1: Head grades from the veins used to obtain final metallurgical balance.

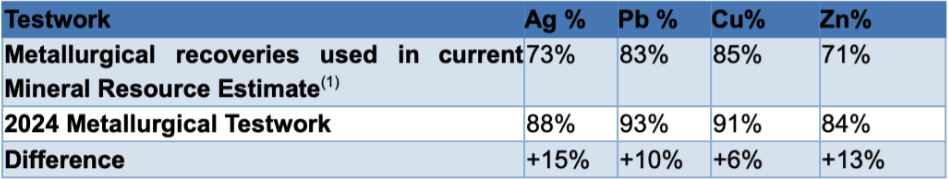

The recent metallurgical testwork represents a significant improvement on the historical metallurgical recoveries used in the preparation of the current mineral resource estimate, as shown in Table 2. Silver recoveries, for example, are 15% higher than the historical values. These improved results will be incorporated into the mineral resource estimate update and the PEA expected in early 2024.

Table 2: Comparison of recent metallurgical testwork results and historical data. Table 2: Comparison of recent metallurgical testwork results and historical data.

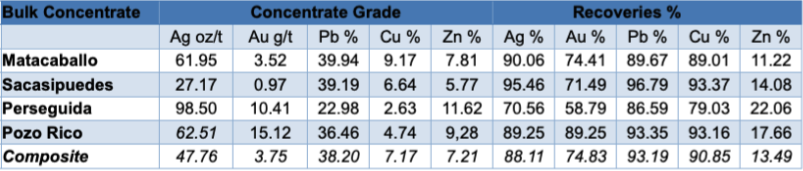

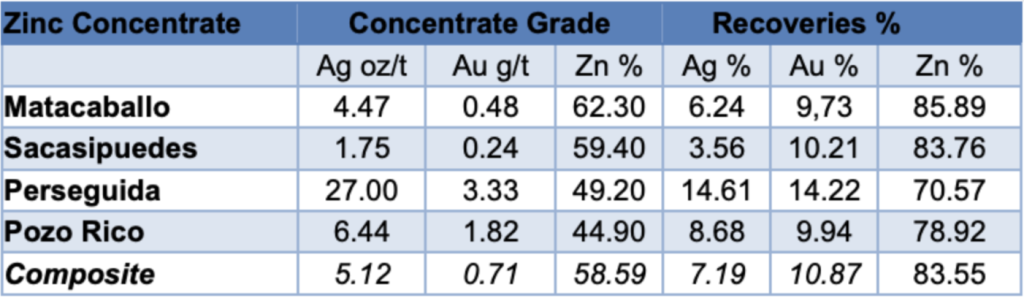

Recoveries and concentrate grades calculated for the bulk, and zinc concentrates are shown in Table 3 and Table 4 respectively. The gold grades and recoveries from the bulk concentrate confirm that gold has the potential to be an important by-product from future production at Reliquias, and no deleterious elements above penalty levels are reported.

Table 3: Bulk Concentrate grades and recoveries

Table 4: Zinc Concentrate grades and recoveries.

Some of the Reliquias veins were not included in this phase of metallurgical testwork, as they have not yet been drilled systematically. However, the samples used for this program is considered representative as they cover the spectrum of observed mineralization styles.

Silver Mountain is not aware of any factors that could materially affect the accuracy or reliability of the data referred to herein.