Cerrado Gold is a Toronto-based gold production, development, and exploration company focused on gold projects in South America.

Cerrado Gold Inc has announced the start of a new exploration campaign at its Minera Don Nicolás ("MDN") mine in Santa Cruz, Argentina, targeting the extension of the Life of Mine ("LOM") and the increase in mineral resources.

The Company has started the first drilling consisting of approximately 3,000 metres on two key high-grade targets, being the Goleta zone and the Calandrias North downward plunge extension. The drilling has the specific objective of providing additional high-grade feed to the CIL Plant. A drill rig has been mobilized to the site and is currently drilling the first hole at Goleta. Any new resources would add to the recent mineral resource estimate completed by the Company and announced on August 6, 2024, providing a 5 year mine life and US$111 million Net Present Value at $2,100 gold ($153M @$2,400Au).

Mark Brennan, CEO and Chairman commented: "With a difficult period of uncertainty now behind us, we are excited to be commencing a new exploration program at MDN where we see the potential to significantly grow the resource base beyond the current 5 year mine life outlined in the recently completed PEA. This new program is specially focused on the potential to rapidly grow high grade resources suitable to be processed at the CIL plant to extend the life of mine. This initial round of drilling is planned to support follow on programs moving forward as the Company aims to rigorously explore our extensive land package."

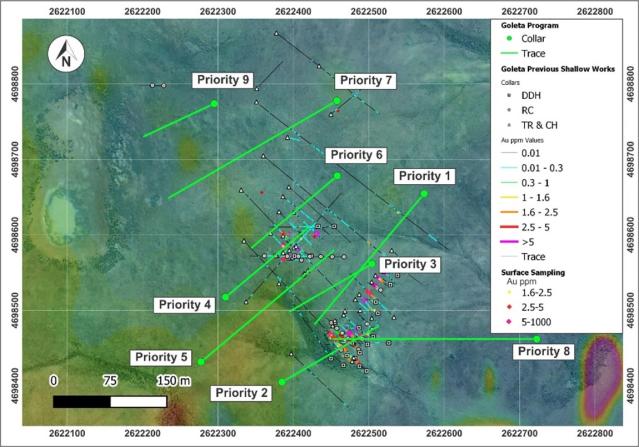

Figure 1. Targets Location

Goleta Zone

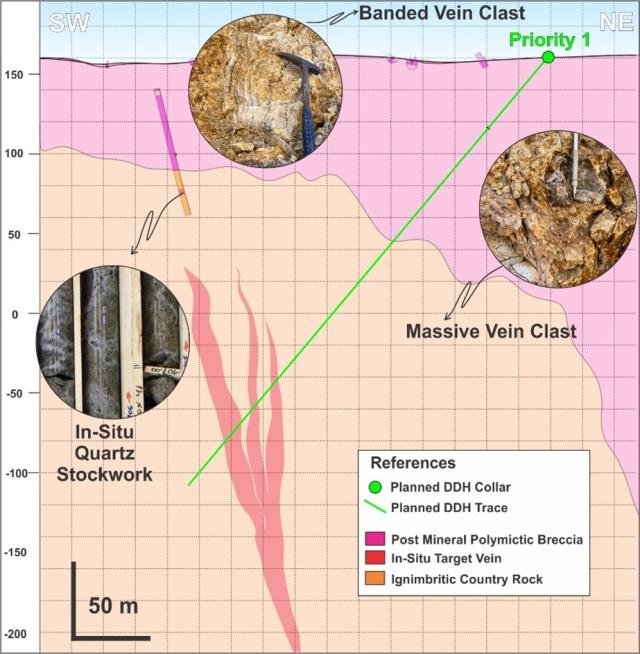

Goleta is a high-grade target located approximately 7 kilometres northwest of the Martinetas mill and CIL plant. Surface exploration has shown the mineralization at Goleta consists of mineralized fragments of banded quartz veins within a polymitic breccia believed to be of phreatomagmatic origin. Phreatic brecciation is late process occurring post mineralization. The exploration premise is that these large clasts are from a high-grade quartz vein system located beneath the breccia and hosted by the underlying Martinetas ignibrite.

Cerrado has conducted soil sampling, geological mapping, trenching, and detailed ground magnetics in Goleta. An IP/Res survey is currently underway to resolve the minimum resistivity contrast between potential quartz mineralized veins and the ignimbritic host rock under the breccia cover. The exploration concept for Goleta is similar to the Marianas vein discovery (Multiple hundred thousand ounces) in the Cerro Negro deposit (Newmont), also located in the Deseado Massif in Argentina. (see Figure 3)

The current plan will target to identify the potential buried primary vein system, believed to be located at lower elevations at vertical projection of areas with a higher density of large, mineralized clasts. Veins could potentially be thick and high grade, considering diameter of clast in the post mineral breccia (up to 2 metres) and Au grade in grab samples of fragments (90 g/t Au). The initial drill plan will target over 600 metres of potential strike length as shown in the figure below to determine the best locations for additional follow up drilling.

Calandrias Norte Deposit

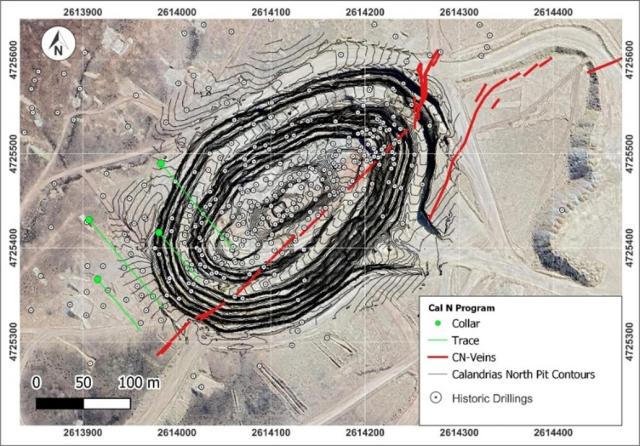

The La Calandria Norte deposit, currently being mined, is a dome-hosted Au-Ag epithermal deposit, located about 600 metres north of La Calandria Sur. The deposit is defined by northeast‐trending veins and vein/breccia mineralization hosted by a Rhyolite dome.

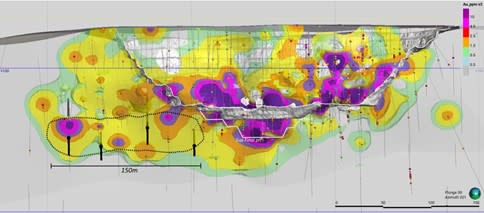

Mining at Calandrias North commenced early this year and is currently the primary source of high-grade feed to the mill and CIL plant. The open pit constrained mineral resource estimate of Calandrias North was recently updated as part of the new PEA technical report of the MDN property including 79 kt at 14.9 g/t Au (37.9 koz) of Measured and Indicated Resource; and 11 kt at 10.7 g/t Au (4.1 koz) in the Inferred category. The deposit is effectively open to the Southwest following the shallow dipping plunge that controls the high-grade mineralization.

A modest four-hole plan aims to prove the continuity of the plunging mineralized trend, characterizing grade, thickness, and overall size potential. The company sees this target as a potential low-capital underground development, utilizing the existing infrastructure in the area.

About Cerrado

Cerrado Gold is a Toronto-based gold production, development, and exploration company focused on gold projects in South America. The Company is the 100% owner of both the producing Minera Don Nicolás and Las Calandrias mine in Santa Cruz province, Argentina, and the highly prospective Monte Do Carmo development project, located in Tocantins State, Brazil under option to Amarillo Mineração Do Brasil Ltda., a subsidiary of Hochschild Mining PLC. In Canada, Cerrado Gold is developing it's 100% owned Mont Sorcier Iron Ore and Vanadium project located outside of Chibougamou, Quebec.

In Argentina, Cerrado is maximizing asset value at its Minera Don Nicolás operation through continued operational optimization and is growing production through its operations at the Las Calandrias Heap Leach project. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package in the heart of the Deseado Masiff.

In Canada, Cerrado holds a 100% interest in the Mont Sorcier Iron Ore and Vanadium project, which has the potential to produce a premium iron ore concentrate over a long mine life at low operating costs and low capital intensity. Furthermore, its high grade and high purity product facilitates the migration of steel producers from blast furnaces to electric arc furnaces, contributing to the decarbonization of the industry and the achievement of SDG goals.