Copper price hits record high as market eyes $12,000 milestone amid tariff buzz

With supply constraints tightening and geopolitical developments accelerating policy shifts, copper is firmly in the spotlight—positioning itself as one of 2025’s top-performing commodities.

Challenger Gold secures first US$2M drawdown from US$20M toll milling finance facility

The initial US$2M (~AUD $3.2M) Tranche 1 proceeds will be used for early works associated with preparation for mining to support Toll Milling, general corporate overheads and working capital.

Blue Sky Uranium launches new JV company to advance Ivana uranium-vanadium deposit in Argentina

Blue Sky Uranium Corp. is a pioneer in uranium exploration and development in Argentina.

Trump fast-tracks potential copper tariffs, shaking global markets

The White House could impose a 25% tariff on copper imports in a matter of weeks, triggering price volatility between New York and London and raising concerns across the global mining industry.

Trump invokes wartime powers to boost critical mineral production

Donald Trump signed an executive order on Thursday that uses the Defense Production Act to support investments in the country’s critical minerals and rare earth elements.

Atex stock rises on best copper-gold porphyry assay yet at Valeriano project in Chile

The Valeriano Project is located in the Huasco Province of the Atacama Region of northern Chile.

Russia plans to launch large-scale lithium production in 2030

Demand for lithium has surged in recent years as Russian companies work on the mass production of lithium batteries and electric vehicles.

Southern Copper mining project attacked in Peru, leaving 20 injured

While companies seek to protect their investments and ensure worker safety, the government faces the challenge of finding solutions that balance economic development with social inclusion and sustainability in the mining sector.

Citigroup predicts LME copper price to hit $10,000 before US tariffs

As the situation unfolds, stakeholders across the mining, manufacturing, and investment sectors will need to adapt to an evolving trade landscape that could significantly influence copper pricing trends worldwide.

Bolivia faces strong public backlash over lithium deals with chinese and russian companies

The Bolivian government maintains that these partnerships will fast-track lithium industry development, promising that the country will retain 51% of the generated profits. However, doubts and social resistance continue to challenge the feasibility of these ambitious projects.

Industry conferences flag critical moment for mining’s transformation

With a growing global demand for critical minerals, two of North America’s largest mining conferences have been exploring the strategies and technologies that will drive the sector’s transformation towards sustainability.

PDAC 2025 attracted more than 27,000 participants

PDAC 2025 which brought together 27,353 participants to explore premier business prospects, investment opportunities, and professional networks in the global mineral exploration and mining sphere.

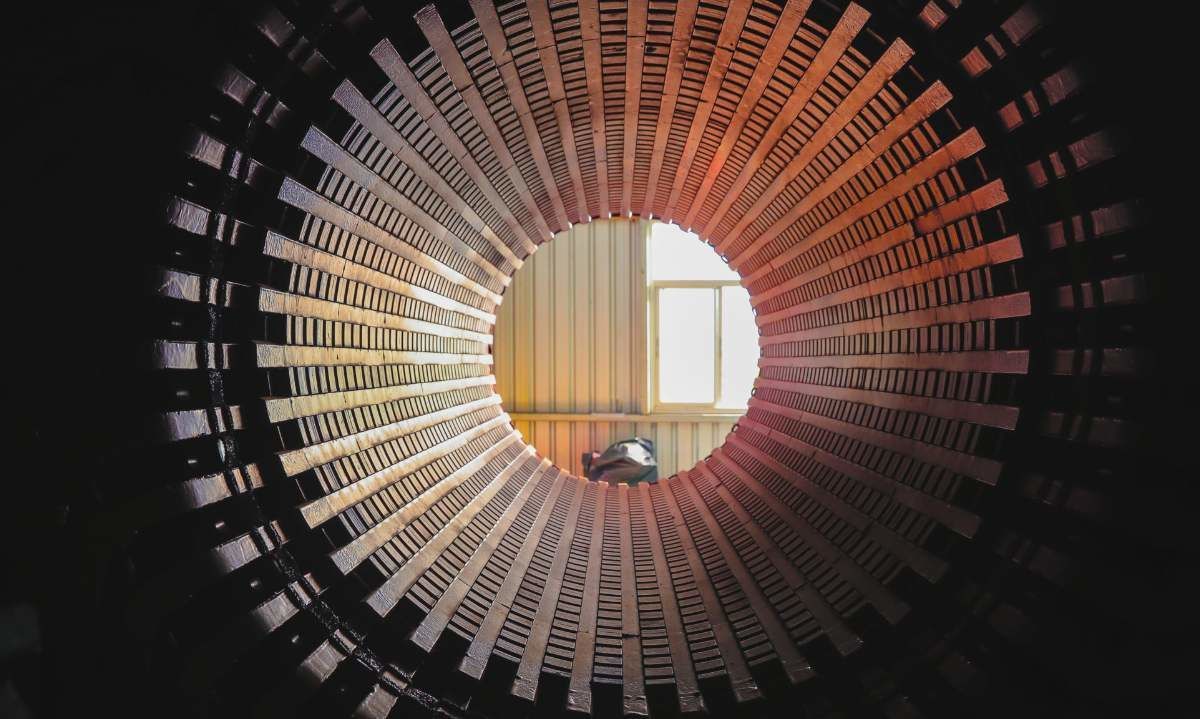

Stator bars in Gearless Mill Drives

In an industry where downtime can result in millions of dollars in losses, ABB’s precision engineering and technological excellence offer an efficient and reliable solution. This allows mining operations to remain competitive, productive, and sustainable.

ABB revolutionizes GMD System Monitoring with MyGMD Widget

The integration of MyGMD Widget with MyABB Portal ensures more efficient and secure management of GMD systems, eliminating the need to search for information across multiple platforms.

ICMM releases updated guidance to strengthen approaches to the closure of tailings storage facilities

The closure of tailings storage facilities is one of the most complex, longest and resource-intensive phases within a mine’s lifecycle.

CAP Announces Strategic Investment in Aclara Resources, Marking its Entry into the Canadian and Brazilian Markets

The company has successfully acquired a 10.18% stake in the Canadian company, which owns the Carina Project in Brazil, the Penco Module in Chile, and a rare earth separation project in the United States.

Codelco and Anglo American sign a historic MOU to promote the development of the Andina-Los Bronces mining district

The companies announced an alliance to implement a Joint Mining Plan that would increase the district's production by nearly 120,000 tons of fine copper per year, between 2030 and 2051.

BYD Secures Mining Rights in Brazil’s Lithium Valley

By entering Lithium Valley, BYD is not only strengthening its battery supply chain but also consolidating its position in Latin America, a key region for the global expansion of electric vehicles.

Vale advances in selling renewable assets in Brazil to Global Infrastructure Partners (GIP)

With this move, Vale aims to enhance the profitability of its energy portfolio by partnering with a strategic player that can drive the growth and operational efficiency of Aliança Energia.

Ukraine and the U.S. strengthen their partnership in the critical minerals sector

To fully develop these critical minerals, Ukraine requires substantial investments and advanced technology. The Ukrainian government is working to create a favorable regulatory environment to attract foreign investors.

Halcones Precious Metals expands mineralized footprint at Polaris Project

With extensive outcrop mineralization and no previous drilling, the project stands as a key opportunity for future investments and exploration in Chile's mining sector.

Ganfeng starts lithium production at Argentina’s Mariana project

The Mariana project not only represents a significant source of foreign currency income but also the creation of genuine, quality employment for hundreds of families from Salta.

Vale announces US$12.2 billion investment to expand iron ore and copper mining in Brazil

This move could strengthen the country’s position in the global mining sector, boost the economy, and create new job opportunities in the Pará region.

McEwen Copper seeks argentine tax incentives for $2.7 billion Los Azules Project

If the incentives are approved and construction begins on schedule, Los Azules could significantly boost the country’s copper production and attract further foreign investment into its mining sector.

China tightens requirements for new copper smelters to curb expansion

As China implements these regulations, the copper market will undergo a period of adjustment, requiring producers and traders to adapt to new supply and demand dynamics.

First Quantum: Final Hearing on Cobre Panama Moved to 2026

The rescheduling of the arbitration process to 2026 prolongs the uncertainty surrounding Cobre Panama and its possible reactivation.

Australia approves tax incentives for critical minerals and renewable hydrogen

With these measures, Australia aims to strengthen its position as a leader in the global energy transition and reduce its reliance on strategic imports from China.